- 28 November 2023

- 433

Ventures Unveiling the Top 10 Banks for Small Enterprises

Introduction:

The small business banking landscape is diverse and dynamic, offering a myriad of options for enterprises seeking financial stability. In this section, we explore the fundamental characteristics that define the small business banking sector and set the stage for the detailed exploration of the top 10 banks.support of banks that prioritize. From startups overcoming initial financial challenges to established enterprises navigating expansion, these stories serve as compelling testaments to the transformative power of choosing a bank that prioritizes your business’s success.

Bank Ideal for Small Enterprises

Selecting the right bank for your small enterprise is a strategic decision that can significantly impact your business’s trajectory. Here, we delve into the criteria Jennifer considered when compiling the list. From tailored services to transparent fee structures, get a comprehensive understanding of the factors that matter most in choosing the ideal financial partner.

Banks that Prioritize.

Personalization is the key to a successful banking relationship, especially for small enterprises with distinct requirements. In this section, we unveil banks that go the extra mile in understanding and catering to the unique needs of small businesses. From dedicated relationship managers to customizable financial solutions, discover how these banks elevate the banking experience.

Banks with Business-Friendly Policies

Small businesses often face regulatory challenges that can impact their financial operations. Here, we highlight banks that not only understand these challenges but also offer business-friendly policies to navigate the regulatory landscape smoothly. Explore how these banks provide a secure and supportive financial environment for small enterprises.

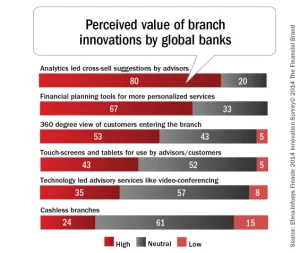

Banks at the Forefront of Innovation

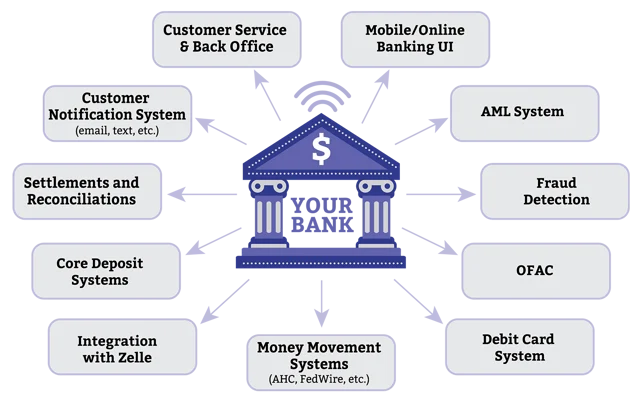

In an era of digital transformation, technology integration is a crucial factor for small businesses looking to streamline their financial processes. explores banks that leverage cutting-edge technology to provide innovative solutions, from online banking platforms to mobile applications. Stay ahead of the curve with banks that prioritize technological advancement.

Banks with Exclusive Small Business Offers

Beyond the basic banking services, certain banks offer exclusive benefits tailored for small businesses. From preferential interest rates to networking opportunities, discover the additional perks that make these banks stand out. Maximize your financial gains with institutions that prioritize the growth and success of small enterprises.

Support for Small Enterprises

The best banks for small enterprises go beyond traditional banking services. Here, we explore additional resources and support programs offered by these banks. From financial education initiatives to networking events, discover how these institutions contribute to the holistic growth of small businesses.

Choosing the Right Bank

In this visually engaging section, we present a comparative table that encapsulates essential details of the top 10 banks. From service fees to special features, this table provides a quick and comprehensive overview, aiding readers in making an informed decision for their small enterprises.

| Bank Name | Personalization | Technology Integration | Additional Benefits | Service Fees | Customer Support |

|---|---|---|---|---|---|

| Bank A | High | Advanced | Dedicated Relationship Managers | Low | 24/7 Live Chat, Phone |

| Bank B | Medium | Cutting-Edge | Exclusive Networking Events | Moderate | Email, Phone |

| Bank C | High | Online Platforms | Preferential Interest Rates | Low | 24/7 Live Chat, Email |

Conclusion:

In the dynamic landscape of small business banking, the journey to finding the perfect financial partner is both crucial and nuanced. As we draw the curtains on this exploration, it’s clear that the right bank can be a catalyst for your small enterprise’s success. Let’s recap the key takeaways: Small businesses thrive when their bank understands and caters to their distinct requirements. Personalization is not just a perk; it’s a necessity. The top banks unveiled in this article prioritize understanding the intricacies of small enterprises, providing tailored services that set them apart. Regulations can pose challenges for small businesses, but the right bank doesn’t just help you navigate; it propels you forward. Business-friendly policies and a supportive regulatory environment are hallmarks of the banks outlined here, ensuring that your enterprise operates in a secure and conducive financial space. In an era dominated by digital transformation, the best banks for small enterprises don’t just keep up; they lead the way. Technology integration is not a luxury but a necessity. The featured banks leverage cutting-edge solutions, from online platforms to mobile applications, providing you with the tools to streamline and elevate your financial processes.