- 4 June 2024

- 47

The High Bar for China Deals in EQT’s Asia Private Equity

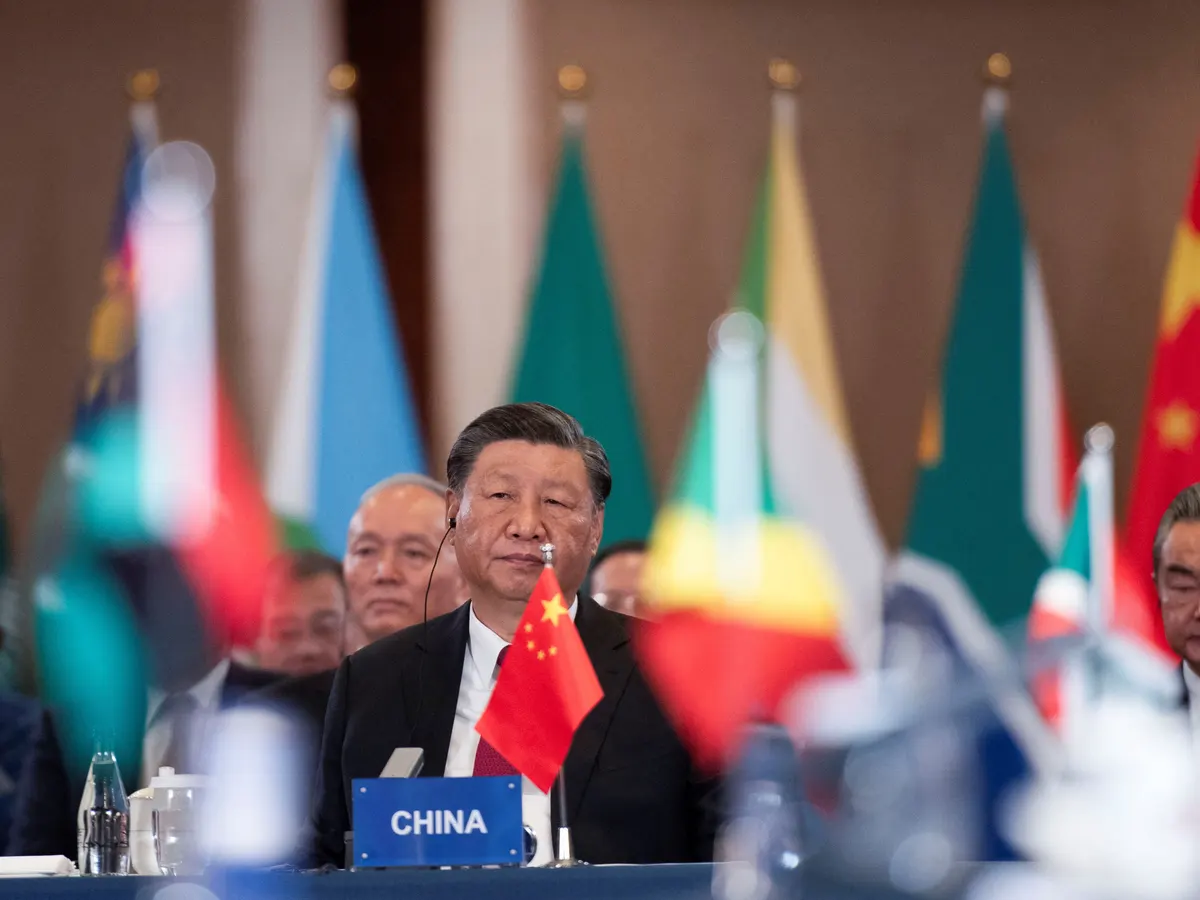

In the dynamic landscape of private equity, China stands out as a tantalizing yet intricate market. Investors, like EQT, are increasingly drawn to its vast opportunities, but as the Chair of EQT’s Asia private equity arm suggests, the bar for success in China deals is set exceptionally high. This article explores the intricacies of investing in China, delving into the challenges faced by private equity firms like EQT and offering insights into the strategies required to navigate this complex terrain.

The Chinese Investment Landscape

China’s economic prowess is undeniable, with its GDP consistently ranking among the highest globally. Its market size, rapid urbanization, and burgeoning middle class make it a magnet for investors seeking high returns. However, beneath the surface lies a landscape characterized by regulatory complexities, cultural nuances, and intense competition.

Regulatory Hurdles

Navigating China’s regulatory environment is akin to traversing a labyrinth. The regulatory landscape, though evolving, remains opaque and unpredictable, posing significant challenges for foreign investors. From restrictions on foreign ownership to stringent approval processes, regulatory hurdles can impede deal execution and necessitate meticulous due diligence.

Cultural Sensitivities

Cultural understanding is paramount in conducting successful deals in China. Building and nurturing relationships based on trust and mutual respect is foundational to business dealings. The intricacies of guanxi, or personal connections, often play a pivotal role in deal-making, underscoring the importance of local partnerships and networks.

Competition and Valuation Pressures

China’s attractiveness as an investment destination has fueled intense competition among private equity players. This heightened competition exerts upward pressure on valuations, making it challenging to identify opportunities offering favorable risk-return profiles. Moreover, the prevalence of strategic investors and state-owned enterprises further intensifies competition and complicates deal negotiations.

EQT’s Approach and Challenges For EQT, a leading global investment firm, navigating the complexities of China’s market is both a strategic imperative and a formidable challenge. As the Chair of EQT’s Asia private equity arm acknowledges, the firm confronts a formidable bar in its pursuit of successful China deals.

Analyzing EQT’s China Deals: A Comparative Table

| Criteria | Challenges in China Deals | Mitigation Strategies |

|---|---|---|

| Regulatory Environment | Opaque and unpredictable | Extensive due diligence and local legal expertise |

| Cultural Sensitivities | Importance of guanxi | Cultivating strong local partnerships |

| Competition and Valuation | Intense competition | Focus on niche sectors and differentiated value |

| Deal Execution | Complex approval processes | Streamlined decision-making and execution framework |

Conclusion

In conclusion, while the allure of China’s market is undeniable, the path to success is fraught with challenges. EQT’s Asia private equity arm faces a high bar in its pursuit of lucrative China deals, contending with regulatory hurdles, cultural sensitivities, and intense competition. Nevertheless, with a nuanced understanding of the market dynamics and a strategic approach focused on building strong partnerships and identifying differentiated opportunities, EQT remains poised to capitalize on China’s vast potential.