- 20 September 2023

- 79

REIT Investing 101: A Beginner’s Guide to Real Estate Investment Trusts

Introduction:

Real Estate Investment Trusts, commonly known as REITs, offer a unique gateway into the world of real estate investing. If you’re a beginner looking to explore the potential of real estate without the hassles of property management, this guide is your essential roadmap. Let’s embark on a journey to understand the fundamentals, advantages, and strategies of REIT investing.

What Exactly Is a REIT?

Defining a REIT

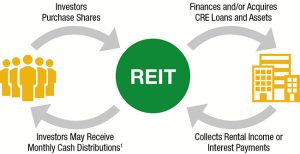

A Real Estate Investment Trust is a company that owns, operates, or finances income-producing real estate assets. REITs pool capital from investors to purchase and manage a diversified portfolio of properties, ranging from residential and commercial real estate to infrastructure and more.

Key Features of REITs

- Diversification: REITs offer investors access to a diverse range of real estate assets without the need for direct property ownership.

- Dividends: By law, REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends.

- Liquidity: REIT shares can be easily bought and sold on stock exchanges, providing liquidity that traditional real estate investments lack.

The Benefits of REIT Investing

Income Generation

REITs are renowned for their reliable income stream. Thanks to their dividend distribution requirement, investors can enjoy a steady stream of income, making them particularly attractive for income-oriented portfolios.

Portfolio Diversification

Investing in REITs allows you to diversify your investment portfolio. By spreading your capital across different types of real estate, you can reduce the risk associated with a single property or asset class.

Accessibility and Liquidity

Unlike traditional real estate investments, which often require significant capital and time commitments, REITs can be bought and sold like stocks. This accessibility and liquidity make them suitable for investors with various budget sizes.

Types of REITs

Equity REITs

These REITs primarily own and operate income-generating real estate properties. Their revenue comes from rent, and they distribute the majority of their earnings as dividends.

Mortgage REITs (mREITs)

Mortgage REITs invest in real estate mortgages or mortgage-backed securities. They make money from the interest earned on these investments and can provide higher yields but also come with higher risk.

Hybrid REITs

As the name suggests, hybrid REITs combine elements of both equity and mortgage REITs. They may own properties and invest in mortgages simultaneously.

Strategies for Successful REIT Investing

Research and Due Diligence

Before investing in any REIT, it’s essential to research and understand the specific market, property types, and management team behind the REIT.

Diversify Your Portfolio

Consider diversifying your REIT investments across different sectors, such as residential, commercial, industrial, and healthcare, to spread risk.

Monitor Interest Rates

REITs can be sensitive to interest rate fluctuations, as higher rates can increase borrowing costs and potentially affect their profitability.

Long-Term Approach

While REITs can provide consistent income, they also benefit from a long-term investment horizon. Consider reinvesting dividends to harness the power of compounding over time.

Conclusion:

Real Estate Investment Trusts offer an accessible and diversified way to participate in the real estate market. Whether you’re seeking regular income or long-term growth, REITs can be a valuable addition to your investment portfolio. Remember, as with any investment, thorough research and a clear strategy are keys to success in the world of REITs. Start your journey into REIT investing today and unlock the potential of the real estate market.